Preamble

In my Macroeconomics Course in College, I was introduced to the Canons of Taxation are principles that guide the design of a fair and efficient tax system. Adam Smith, in his book *The Wealth of Nations*, introduced four fundamental canons of taxation:

- Equity: Taxes should be proportional to the taxpayer’s ability to pay. This means that individuals with higher incomes should pay more taxes than those with lower incomes.

- Certainty: The tax amount, payment time, and method should be clear and certain to the taxpayer. This helps in planning and reduces the chances of arbitrary taxation.

- Convenience: The tax system should be convenient for taxpayers to comply with. This includes the timing and method of tax payments.

- Economy: The cost of collecting taxes should be minimal. The tax system should not be overly expensive to administer.

Modern economists have expanded these canons to include additional principles such as productivity, elasticity, simplicity, and diversity.

However many Governments around the world, including India do not follow these Canons of Taxation and make the taxation more complex rather than simplistic. From an investor point of view, the latest Budget for FY 2024-25 is one such instance where the Ministry of Finance has demonstrated one case of positive and one case of negative principles of canons of taxation. From an investor point of view, on the positive side, the Budget has abolished the Angel Tax and on the negative side, the Budget has abolished the indexation applied on Long-Term Capital Gains (LTCG) for computation of LTCG by reducing the LTCG rate from 20% with indexation to flat 12.5%. Let’s discuss this in detail.

Angel Tax Abolition – Positive Canon of Taxation

When late Finance Minister and President of India Pranob Mukherjee, introduced the Angel tax in 2012, the justification given was that it was to prevent money laundering through inflated valuations. However, most start ups are valued higher than fair market value. Most angel investor would value these angel investments looking at the future growth potential and at the time of investments, these start ups had no or low revenues and profits. It is but obvious that the valuation methodologies would be higher than the market value. The angel tax had several significant impacts on startups in India:

- Valuation Challenges: Startups often faced difficulties in justifying their valuations to tax authorities, leading to disputes and potential tax liabilities.

- Investor Hesitation: The tax created uncertainty and risk for angel investors, making them more cautious about investing in early-stage startups.

- Cash Flow Issues: Startups had to allocate funds to cover potential tax liabilities, which could otherwise have been used for growth and development.

- Administrative Burden: The process of proving fair market value and dealing with tax assessments added to the administrative burden on startups.

- Stifling Innovation: The overall environment of uncertainty and additional financial strain could stifle innovation and discourage entrepreneurship.

With the abolition of the angel tax in 2024, the startup ecosystem is expected to benefit from increased investor confidence and a more supportive regulatory environment.

Conclusion

The Angel tax did not pass the Canons of Taxation test and met its stated objectives. After lobbying for many years it is now abolished.

Removal of Indexation on LTCG for Sale of Real Estate

In the current budget, the Finance Ministry has removed the indexation benefit for calculating long-term capital gain (LTCG) on non-financial assets (including property). It has also lowered the LTCG tax rate to 12.5% (from 20% previously). The government has clarified that the removal of indexation benefits will not be applicable to old properties held before 2001, which would continue to get indexation benefits. This move is unlikely to impact the end-users who sell their existing house and reinvest in a new house (LTCG is not applicable). However, it will impact investors who would sell their house (investment) and reinvest in other asset classes.

Now the statement coming from the Finance Secretary in the media is that the new LTCG tax regime is in favour of the taxpayer as it lowers the LTCG burden. However,

this is not the case. Let is analyse this in detail.

Indexation on LTCG

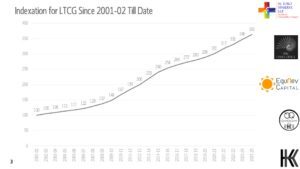

There is an adjustment to the cost of acquisition of real estate of offset the inflation. Since 2001 onwards is the time frame when the new LTCG tax regime will impact the taxation, the following chart shows the indexation with 2001-02 as 100.

Assuming that an investor bought the property in 2001-02 at INR 100, the indexation benefit will be that if sold in 2024-25 it will be valued at INR 363, that is a multiple of 3.63x and this will be the cost that will be deducted from the sale consideration for computation of LTCG on the profit on the sale of the property. Now this benefit has been removed and a flat rate of 12.5% of sale consideration. This change has its own pros and cons and debunks what the Finance Secretary talked to the media about the new LTCG tax regime. Let’s see the different scenarios and time frame and the tax burden under the two LTCG tax regime.

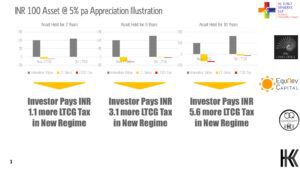

INR 100 Asset @ 5% pa Appreciation Illustration

Clearly, the investor pays more LTCG when the indexation benefit is removed with lower tax rate of 12.5%.

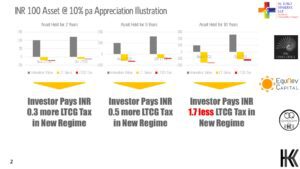

INR 100 Asset @ 10% pa Appreciation Illustration

The investor only gains to pay less tax if the property is held for 10 years and more and appreciates in value @10% pa. Therefore we can conclude that the impact on relatively shorter-term investments (<5 years) where market price growth is <10% p.a. is negative. Conversely, the impact of this new regime would be neutral/marginally beneficial for investments with longer holding period (>10 years) and where property price appreciation is at >10% p.a.

It’s a Bummer

As a healthcare real estate fund, the social infrastructure like hospitals do not appreciate > 10% pa. Also the investment and exit timeframe would be <5 years. This means that there is additional tax burden for the investors. However, we are not the only institutional investors who are impacted with this change in LTCG tax computation. The recent change in LTCG tax computation bring about many questions around the cannons of taxation and many more. These include:

- Healthcare real estate in India is one of the most costliest in the world and hence its relative attractiveness reduces for international investors towards India due to the additional tax burden.

- There should have been exceptions allowed for funds and institutional investors for their existing investments in property sector to allow for the projected returns. Any new investments could have been based on the new LTCG tax proposal. This will allow for certainty of gains and returns to the investors in their current investments.

- There are doubts in the minds of the investors about the stability of the LTCG tax regime if they are tweaked in the name of lower tax burden which is totally not true.

- The secondary sale of the property by investors may alter the exit process by the investors in terms of time and valuation to match the increased LTCG tax burden suddenly imposed under the new regime.

- The real valuation of the property may be tweaked with cash in the transaction to lower the LTCG tax.

- Other creative accounting practices may be introduced to capitalise on the property inflate their costs to offset the loss due to increased LTCG tax burden.

To conclude, the new LTCG tax regime on property is not a positive one and does meet the canons of taxation and is not going to meet its objectives like the abolished Angel Tax.